Author: Curotec

Cell Therapy: A View Towards Advantages and Disadvantages of Four Approaches

Immune effector cell (IEC) therapies, commonly referred as cell therapies, utilize human cells to cause or enhance an immune response against tumor cells. Following remarkable successes with several patients in the early 2010s – most notably, the case of Emily Whitehead, the first pediatric CAR-T patient, who recently celebrated 10 years of being cancer-free – IECs have become a key focus of investigations to help treat multiple types of cancer, resulting in several approved therapies and hundreds of ongoing trials.

Here, we briefly define the four main groups of IECs currently under research: chimeric antigen receptor T cells (CAR-T), engineered T cell receptor (TCR) T cells, tumor-infiltrating lymphocytes (TILs), and natural killer (NK) cells, with a view towards advantages and disadvantages of each approach.

CAR-Ts: the first and currently only approved IEC therapy, autologous CAR-Ts take advantage of the patient’s own T cells to fight the tumor. Circulating T cells are collected and engineered ex vivo to express a customized receptor, the CAR, which recognizes and binds to a surface protein (antigen) in the tumor cell, inducing cell death.

- Advantages: can target any protein expressed in the tumor cell surface; do not rely on antigen presentation by human leukocyte antigen (HLA) complex; capable of memory formation and long-term persistence to monitor and prevent tumor recurrence; approved by the FDA for certain patient populations with hematological tumors

- Disadvantages: limited to proteins expressed in the cell surface; do not distinguish tumor from non-tumor proteins, leading to high risk of on-target, off-tumor toxicity; vulnerable to relapse due to antigen escape (loss or downregulation of target surface protein); autologous CAR-Ts involve a complex manufacturing process that require several weeks from prescription to infusion and are very expensive due to their personalized, non-scalable nature

CAR-Ts can also be generated from allogeneic sources (i.e., T cells collected from healthy donors rather than the patient’s own T cells), reducing costs and shortening time to treatment; however, allogeneic cells require additional precautions to prevent graft vs. host disease. Data for allogeneic CAR-Ts remains in the early stages, and no allogeneic CAR-Ts have been approved so far.

TCR Ts: as in autologous CAR-Ts, T cells are collected and engineered ex vivo, in this case, to express engineered TCRs. The chosen receptor usually derives from a library of endogenous TCRs that are known to target tumor-associated antigens.

- Advantages: potential to recognize any antigen that would be presented by HLA complex (i.e., not restricted to cell surface proteins); “natural” signaling (as opposed to CAR-Ts) may translate to reduced toxicity and ability to recognize and target low-density antigens

- Disadvantages: risk of mispairing endogenous and inserted TCR subunits could lead to off-target toxicity; patient population for any given TCR is limited by HLA subtype; as with CAR-Ts, manufacturing is complex and time-consuming, and when approved, products are likely to be similarly expensive

TILs: unlike CAR- and TCR-Ts, TIL therapies are not engineered to target a specific antigen; instead, they are naturally occurring T cells with antitumor activity. TILs are collected from a solid tumor sample, separated from the tumor cells, expanded ex vivo, and tested for tumor recognition. The lymphocytes (T cells) that successfully target and kill tumor cells are delivered back to the patient.

- Advantages: long-term persistence of lymphocytes circulating within immune system; ability to target multiple antigens and increase efficacy against solid tumors, which are highly heterogeneous; next-generation TIL therapies are being engineered for enhanced activity, persistence, and resistance to immunosuppressive tumor microenvironment

- Disadvantages: require patients to have preexisting lymphocytes with high and specific antitumor activity in a tumor that is accessible for biopsy; allogeneic TILs are unlikely to be feasible, since TILs are selected based on endogenous activity against the tumor

NK cells: a rapidly emerging field in IEC, NK cells play a role in immunosurveillance and are guided to tumor sites by chemokines and their associated receptors. NK cells do not naturally express TCRs but could be engineered to express TCRs or CARs.

- Advantages: allogeneic NK cells do not cause graft vs. host disease (as allogeneic T cells may) and are unlikely to cause cytokine release syndrome; capable of antibody-dependent, cell-mediated cytotoxicity (ADCC: antibodies bind to surface antigens on the tumor cell, the NK cell recognizes the antibodies, and mediates cell lysis to destroy the tumor cell), which enables combination of NK cells with therapeutic antibodies to target additional antigens and enhance antitumor response; many sources for collection of NK cells (peripheral blood mononuclear cells, umbilical cord blood, hematopoietic progenitor cells, iPSCs); several studies currently exploring potential of allogeneic NK cells

- Disadvantages: autologous NK cells may not be feasible since they are usually dysfunctional in cancer patients; short term persistence, due to NK cells being part of innate immune system and general shorter persistence of allogeneic vs. autologous cells

There are now six autologous CAR-T therapies approved by the FDA, all of which target either CD19 (for ALL and non-Hodgkin’s lymphoma) or BCMA (for multiple myeloma). These therapies have demonstrated high and durable response rates in late-stage diseases, which are likely to be cures in some cases.

All these successes have come in hematologic malignancies, but even in those indications, less than 50% of patients achieve long-term remissions. Therefore, there is substantial room for improvement, and many next-generation approaches are under investigation, including multi-antigen targeting, resistance to immunosuppression, and checkpoint inhibition.

New approaches aim to both improve outcomes in hematologic malignancies and drive meaningful efficacy in solid tumors, which are more complex and difficult to treat. Furthermore, cost and time requirements will drive advances in allogeneic, off-the-shelf products and point-of-care manufacturing with the goal of expanding accessibility of these life-saving therapies.

To facilitate understanding and tracking of the complex and rapidly growing field of IEC therapies, SAI’s team of experts has developed CellTraQ, a comprehensive database of cell therapy assets and clinical trials. Whether you want to discuss our strategic consulting capabilities in Oncology or discover the power of CellTraQ, please contact us today.

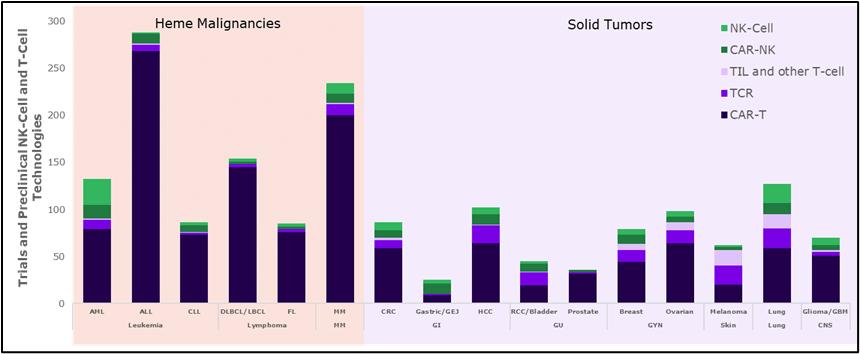

CellTraQ data search of oncology studies involving T and NK cells divided by tumor type.

SAI MedPartners takes on strategic investment from Northlane Capital

Our CEO Erik Nordhoy talks about the new partnership

SAI MedPartners has recently taken on a strategic investment from Northlane Capital Partners, a leading private equity firm focused on the healthcare sector. This investment will provide growth capital to enable SAI to accelerate key initiatives to strengthen our client engagement model, augment our suite of services and further expand our global footprint.

Why is this the right time for SAI to take on an equity investor partnership?

I really believe we had reached an inflection point in our journey, which has been characterized by rapid expansion and double-digit revenue growth for over a decade. Our established global footprint, leadership position in the core strategic intelligence offering, and portfolio of nascent new offerings will all benefit tremendously from the additional capital and thoughtful external perspective that this partnership with NCP brings.

What does it mean for the future of SAI?

From a strategic perspective, the growth capital will help us become a better thought partner and allow us to broaden the range of services that we can provide to our clients. Since our inception, SAI has been laser-focused on keeping clients apprised of threats and opportunities within the competitive landscape in which they operate. However, our clients are increasingly seeking partners who can also incorporate other elements of decision support such as forecasting, market access, and pricing strategy development. In short, clients seek partners which can provide a more strategic perspective that incorporates many of these elements. And while we have already developed some of these internal capabilities to fulfill our clients’ needs, we see a fantastic opportunity to deploy capital to accelerate that effort.

What can our clients expect?

Clients can, first and foremost, expect the same level of commitment, responsiveness, and high-quality strategic intelligence partnership which they have come to expect over the years. Beyond that, our new partnership will accelerate critical initiatives which will enable more effective client engagement tools, knowledge-based content assets, and additional services. The acceleration of IntelliTraQ 2.0 (our proprietary portal platform) and additional content data assets to augment our exciting CellTraQ and GeneTraQ data offerings are only two examples. Our clients are looking for a smaller number of strong partners to support their strategic planning needs effectively and broadly. The capital deployment capability of NCP’s investment will enable us to do that.

The SAI talent factor

SAI’s foundation and success in the market are, and always have been, built on the exceptional talent, experience, and passion of our team. As we look to expand our offerings, the additional capital we now have available to us will support the aggressive acquisition of talent specific to different functionalities and strengthen our key therapy area teams. SAI is committed to continuing to build deep functional and therapy area expertise in key areas of growth within the pharmaceutical sector from a human capital perspective. We are excited that Northlane Capital shares our vision to invest in the recruitment and retention of the very best talent available.

How are we leveraging the investment to expand SAI’s Asia team?

Within our competitive set, Asia is a strategic differentiator for SAI which allows us to provide a truly global support capability that is unique and of tremendous value to our clients. There really is no other competitive intelligence provider that has a comparable footprint in the region which, for us, is anchored in our team of over 40 full-time employees between our Beijing and Shanghai offices. Our new partnership with NCP provides an opportunity to “double down” on our Asian leadership position by expanding the range of functional offerings to our clients in China and promoting further geographic expansion into Japan and other markets within Southeast Asia.

Strategic investment priorities

As an organization, we are intensely focused on the execution of our three-year plan to drive growth along three dimensions. First, we are doubling down on the investments we have made in our TheraTraQ content databases, IntelliTraQ platform, and syndicated offerings. Second, we are expanding our adjacent offerings in forecasting and portfolio strategy, market access and pricing strategy support as well as targeted qualitative market research. Third, we are aggressively growing our geographic footprint, particularly looking at Japan, South Korea, Taiwan, and Singapore. Our ultimate objective is to firmly establish SAI as one of the world’s leading broad-based strategy support partners for our clients. Successful execution of the three-year plan will take us a long way toward achieving this goal.