It is no secret that social media is an essential channel for expressing opinions and sharing facts. Depicted through visual representations and the written word, the world works fundamentally through online channels, without which we would be thrown back into a rudimentary and non-progressive lifestyle.

Social media has given the world a glimpse of the amazing accomplishments the healthcare industry has achieved, as well as what we can bring about in the future. From various research on the selection of molecular candidates and all phases of clinical trials, to drug launches and promotional campaigns, the healthcare sector now heavily relies on insights from social media platforms.

Information-sharing and peer support social media platforms have both directly and indirectly enabled the healthcare industry to improve the quality of medication and care, while aiding online communities and individuals dealing with various ailments. PulseTraQ, a unique digital and social media intelligence, has been created to further advance the way pharmaceutical companies gather data and enhance efficiency.

Through PulseTraQ we create topline social intelligence reports for our clients…

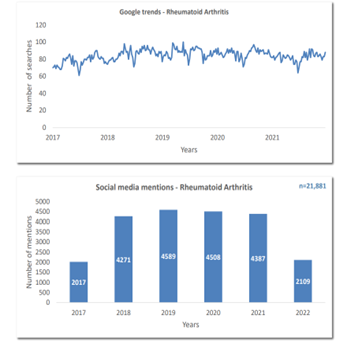

Here is an example of an intelligence report focused on Rheumatoid Arthritis. Through the intelligence of PulseTraQ, our social media analysis revealed that within the last 5 years the treatment space for rheumatoid arthritis has evolved and seen improvements in terms of efficancy and reduced disease progression. Additionally, we can conclude that although certain prescribed medications were observed in conjunction with rheumatoid arthritis, they also cater to other diseases such as Psoriatic Arthritis, Ankylosing Spondylitis, Crohn’s disease, Ulcerative Colitis, various forms of cancer, as well as other common and rare indications.

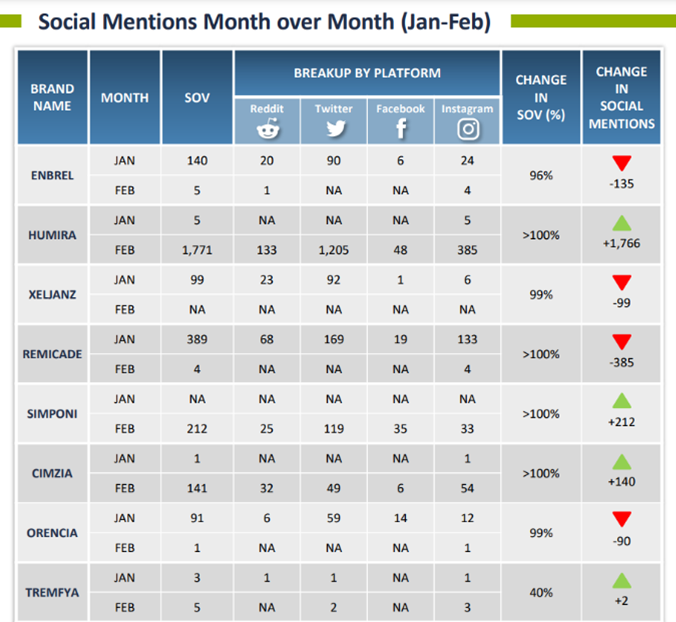

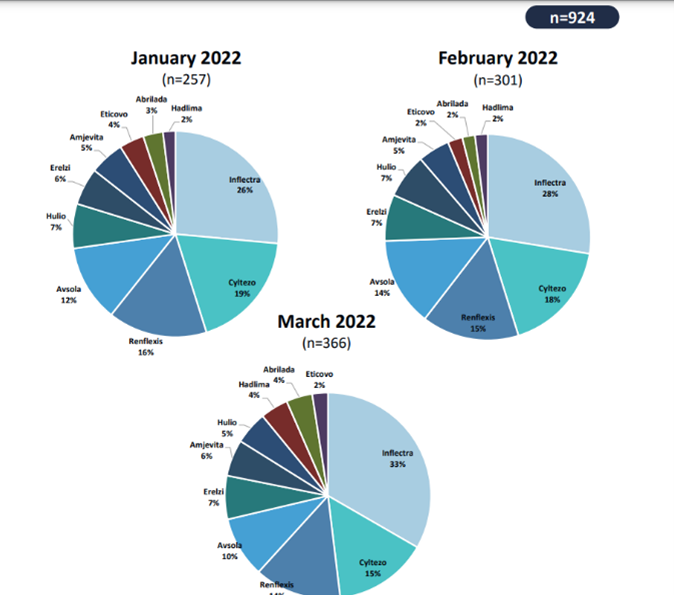

The range of benefits PulseTraQ offers continues to expand as the need for more specific social and digital intelligence analyses grows. Through PulseTraQ, we can look at search trends for different brands, share of voice for brands and biosimilars, monthly brand mentions, and top keywords. The rich, unprompted sentiments expressed by the patient and medical community through social media platforms acts as an invaluable source of input, to better the healthcare field.

PulseTraQ is an indispensable tool for pharmaceutical and healthcare companies that we are excited to offer throughout the industry. A full social intelligence report includes everything from brand mentions, SERP analysis, and geographic splits, to historical analysis, top reporters’ data, and so much more.